Videos

Portfolio Gains and Diversification Losses

2025 brought strong returns, but when assets move together, diversification can break down. Learn how Compass Wealth helps clients manage risk heading into 2026.

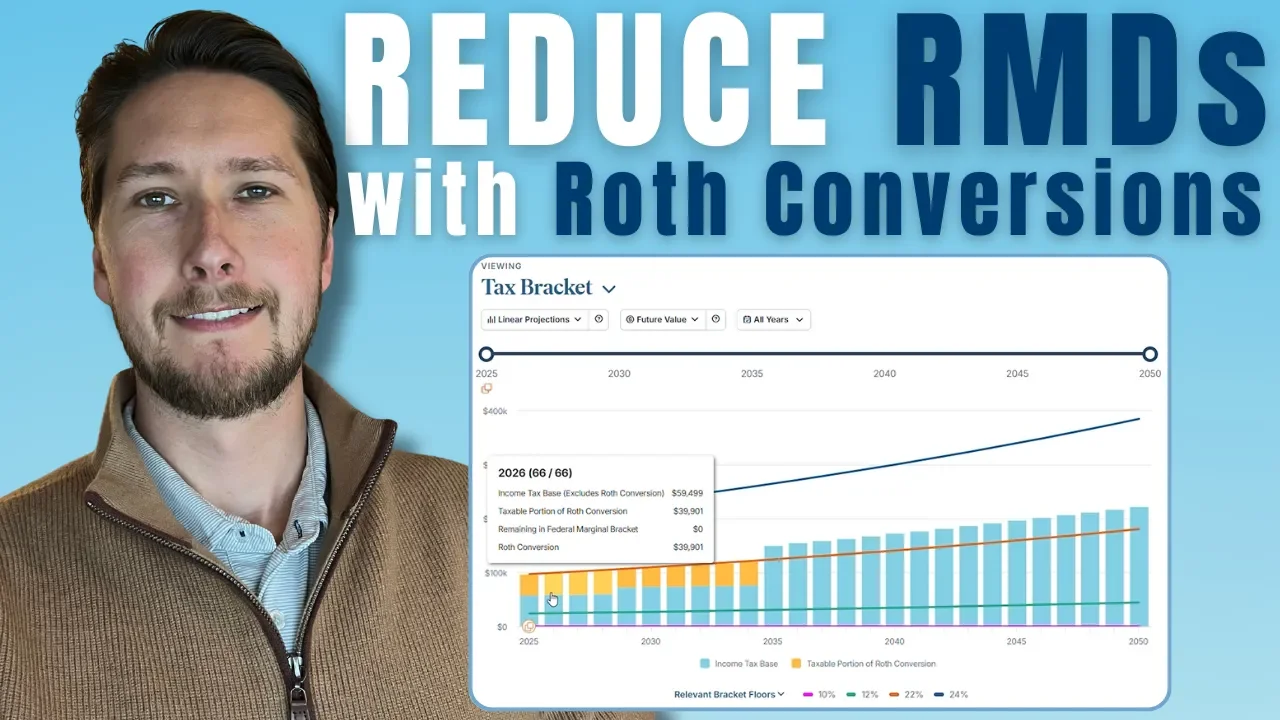

How to Reduce Taxes & RMDs with Smart Roth Conversions

Discover how Roth conversions can reduce required minimum distributions, lower your lifetime tax burden, and improve your legacy strategy.

What You Need to Know About the AI Bubble

AI-related investment is surging but does it signal a bubble? Learn how Compass Wealth Management helps investors evaluate risk and stay prepared.

Why an HSA Will Supercharge Your Wealth

Learn how Health Savings Accounts (HSAs) offer triple tax advantages and long-term wealth-building potential for your retirement plan.

Easy Explanation of U.S. Debt Issue

Federal interest payments now exceed defense spending. Learn what this means for your retirement plan and how Compass Wealth Management helps clients prepare.

Big Changes to Medicare Coverage on the Way

Rising costs, fewer doctors, and less coverage. Learn what is changing for Medicare Advantage in 2026 and how Compass Wealth Management helps retirees plan with confidence.

Staying Safe: What's New in Financial Fraud

Learn how fake texts, phone scams, and AI-powered fraud are targeting investors in 2025. Robert Amato of Compass Wealth Management shares tips to protect your finances and avoid scams.

Can Your Financial Plan Survive a Market Crash?

Learn how stress testing your financial plan can help you prepare for market downturns, long-term care, and tax increases. A smarter retirement strategy starts here.

What No Taxes on Social Security REALLY Means

Learn how the Enhanced Senior Deduction affects Social Security taxes in 2025 and how Compass Wealth helps reduce your taxable retirement income.

Tax Planning Webinar Series: The New Tax Laws You Can Leverage Now

Explore 2025 tax law changes with Robert Amato, CFP®. Learn strategies to help retirees and high earners save before year-end.

A Concerning New Trend in AI Companies

Discover how circular capital flows are shaping AI company growth in 2025. Robert Amato of Compass Wealth Management explores how this financial trend may impact valuations, risk, and long-term investment strategy.

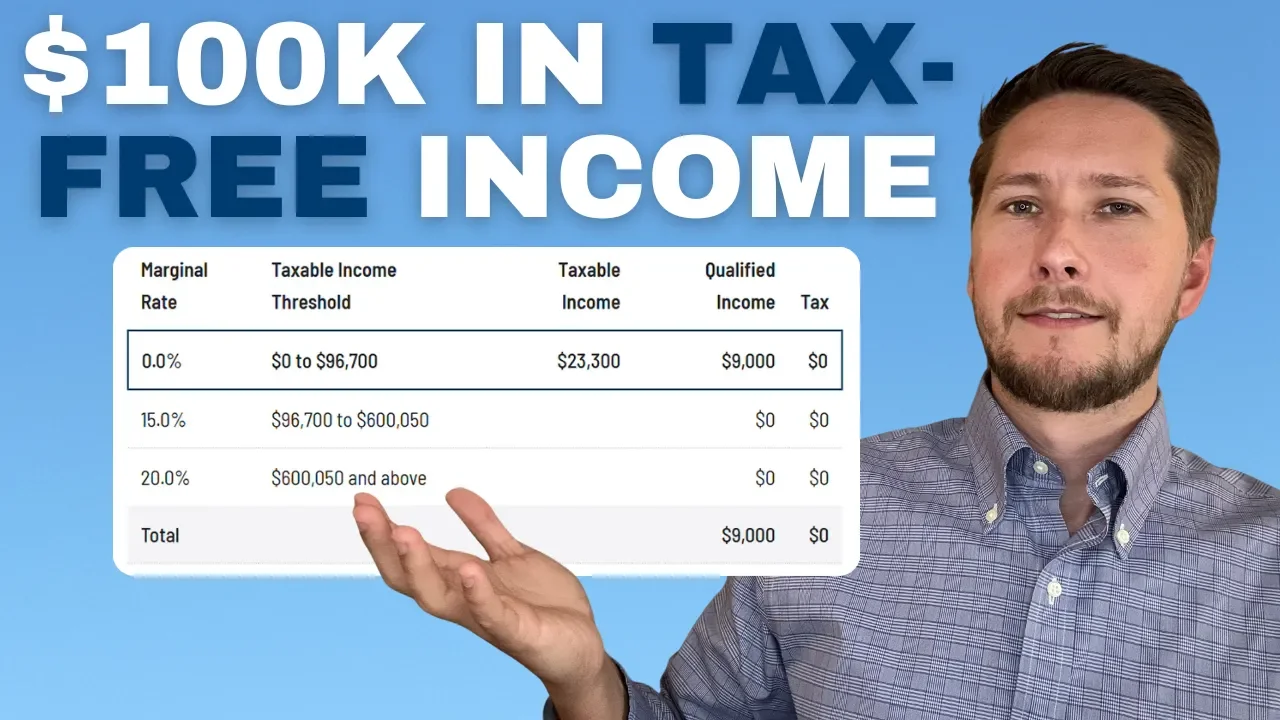

Taxes in Retirement | Guide to Saving Thousands

Explore how the 2025 tax law changes, including the SALT cap increase, new senior deduction, and higher retirement contribution limits, could affect your financial plan. Compass Wealth Management breaks it down.

2025 Tax Changes That Could Impact Your Retirement

Explore how the 2025 tax law changes, including the SALT cap increase, new senior deduction, and higher retirement contribution limits, could affect your financial plan. Compass Wealth Management breaks it down.

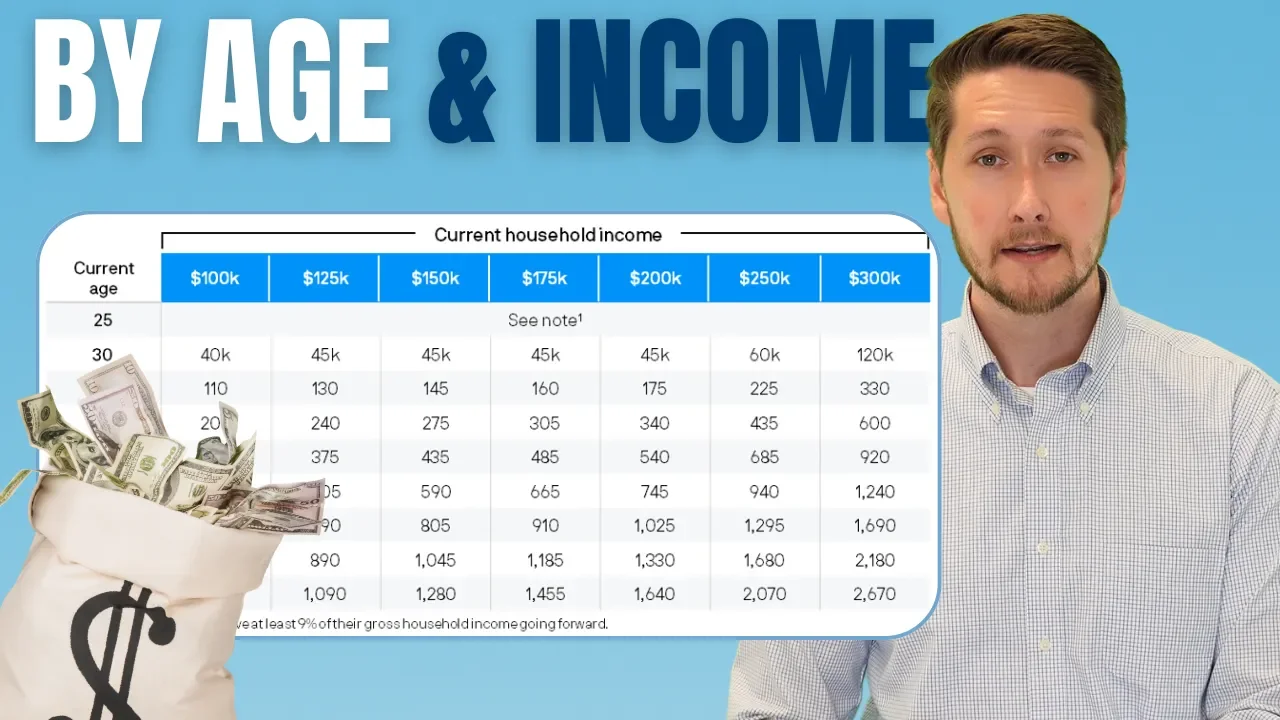

How Much You Should Have Saved By Age

Wondering how much you should have saved for retirement by now? Use these income-based benchmarks to check your progress and plan your next steps with confidence.

A Warning Sign for Real Estate Prices?

Robert Amato, CFP®, CIMA® breaks down why a sharp drop in lumber prices may be more than a materials story. As a leading indicator, lumber has historically signaled turning points in the housing market.

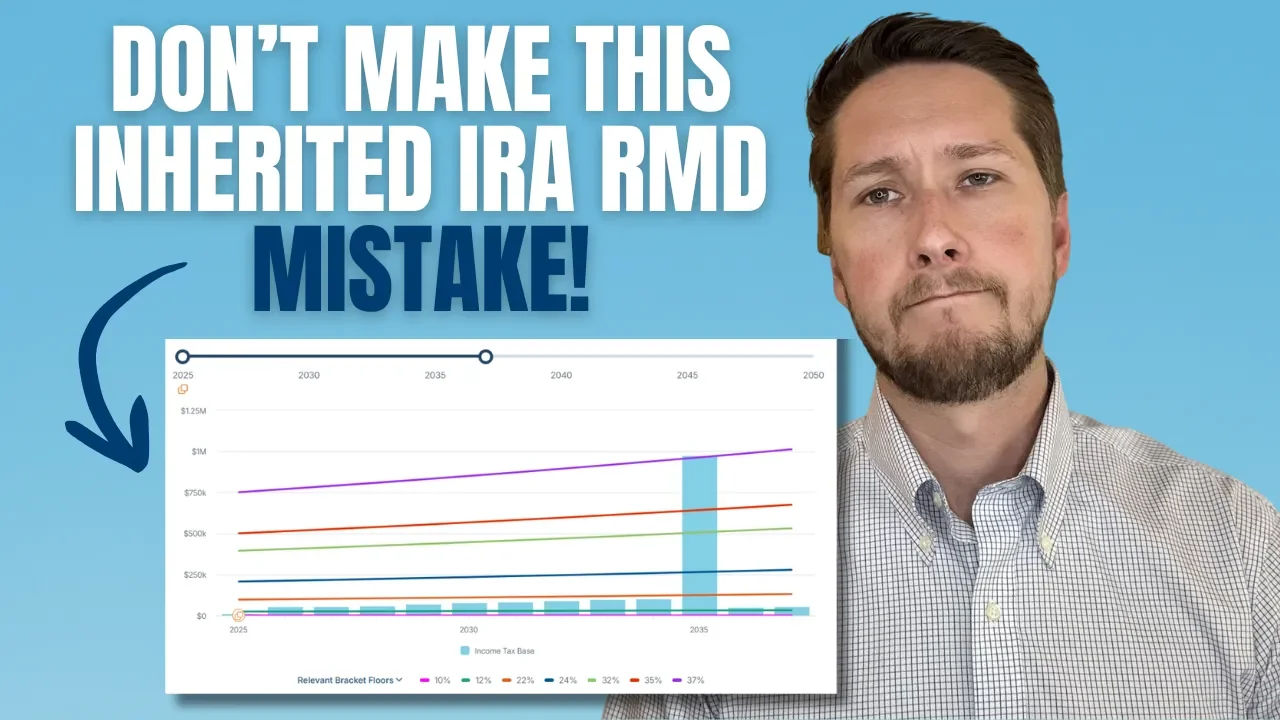

INHERITED IRA RMD | NEW 2025 CHANGES!

In this video, Lance Miller, CFP®, explains the current required minimum distribution (RMD) rules for inherited IRAs.

Why We Built Compass: A Better Model for Financial Planning

Robert Amato explains the story behind Compass Wealth Management, detailing how a commitment to planning, unbiased advice, cost transparency, and consistent strategy shaped the firm. No commissions, no hidden agendas, just ongoing planning tailored to real client needs.

Backdoor Roth | Everything You Need to Know

When high earners can’t contribute directly to a Roth IRA, the backdoor Roth can be a valuable strategy. But if you don’t understand the IRS rules, you could create an unexpected tax problem.

What History Teaches Us About Inflation and Investing

When we think about major market downturns—1929, 1973, or 2000—what often comes to mind is volatility and loss. But history shows that inflation and valuations play an even bigger role in long-term outcomes.

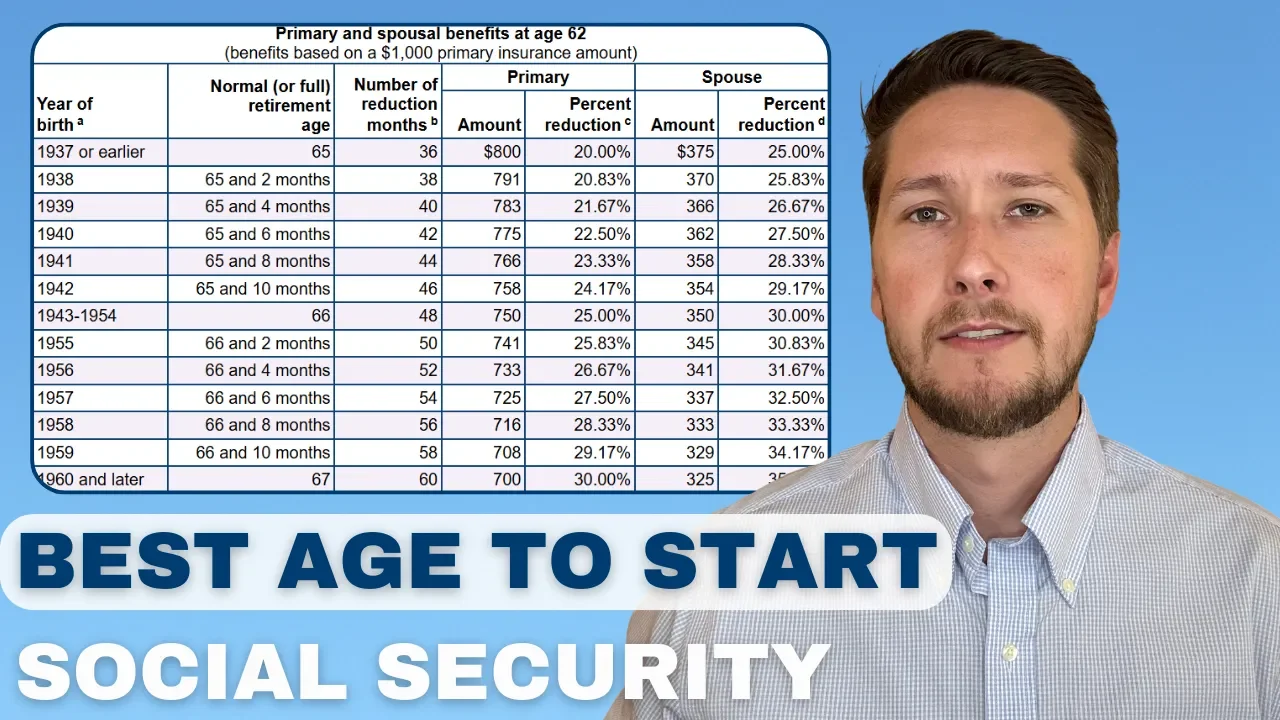

Social Security | Best Age to Start

When should you start Social Security benefits? The decision can impact your retirement income for decades.